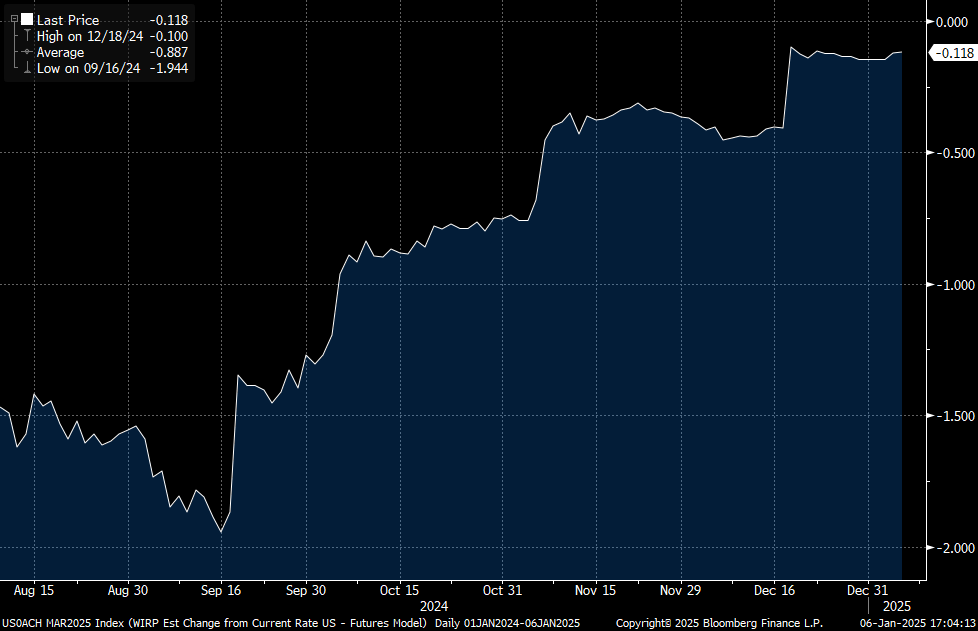

Since I believe US unemployment should be a bit higher in December and January, given difficulty of finding a new job and declining job ads, I got into some SOFR March call spreads before December nonfarm payrolls report. I find odds of more cuts being price in during the next two Fed meetings attractive.

SFRH5 96.0625-96.125 are offered at 0.5c. For that to play out, Fed needs to cut in January and probability of a March cut should settle around 30%. Potential return is 12.5x the premium paid.

At the moment markets assign 50% probability of a single cut, or 12bp in total in January and March.