US consumer activity is rolling over, following the first layoffs and poor stock market performance. Employment has deteriorated and is expected to increase further. And policy put might be lower than what people wished for. FED might be forced to stay too restrictive given unfavorable core CPI and PPI mixes.

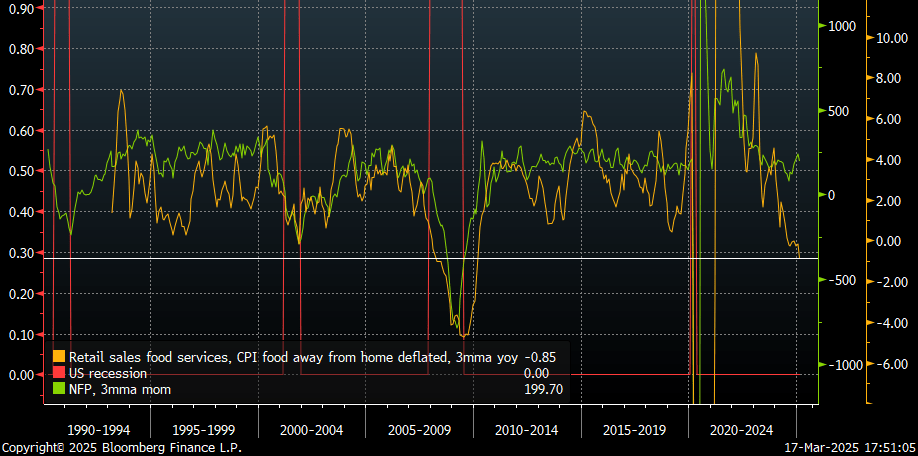

Slowdown in discretionary retail spending is significant. Current decline in real restaurants spending is getting similar to the GFC levels (ex Covid shutdowns).

On an aggregate retail sales basis, seasonal adjustment factors were very beneficial this February.

Soft consumer labor sentiment is collapsing. This could be exaggerated by strong political bias of the surveys. But even this uncertainty will curtail private activity plans too.

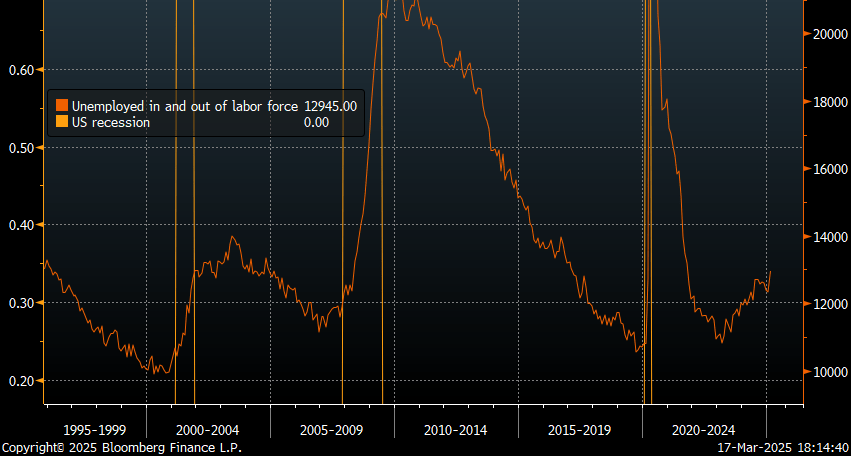

And already now the actual number of people who want a job jumped to a new cycle high in February.

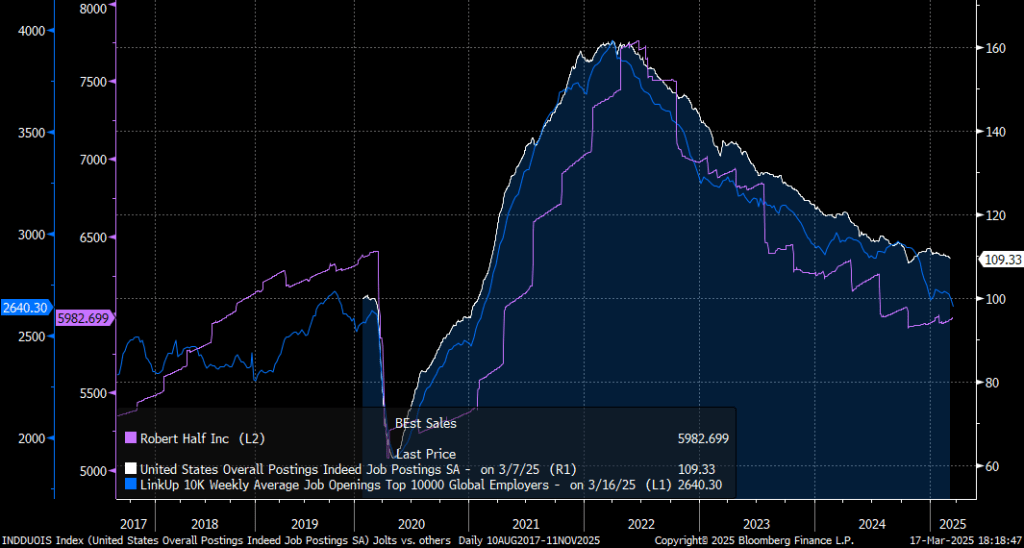

Labor demand continues to soften, as job ads are falling to new lows.

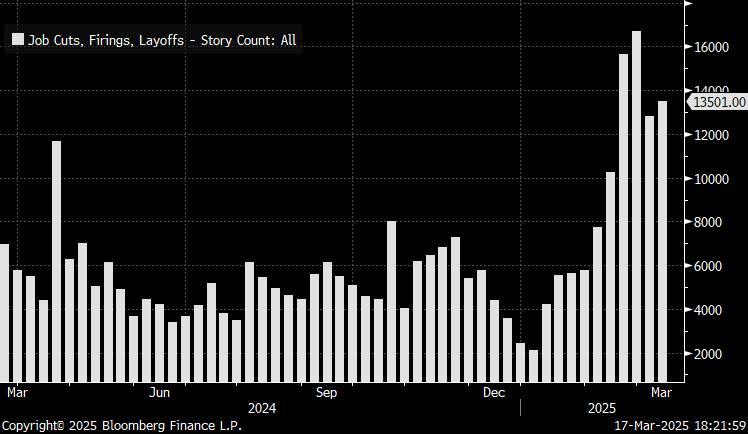

And number of layoff mentions remain elevated.

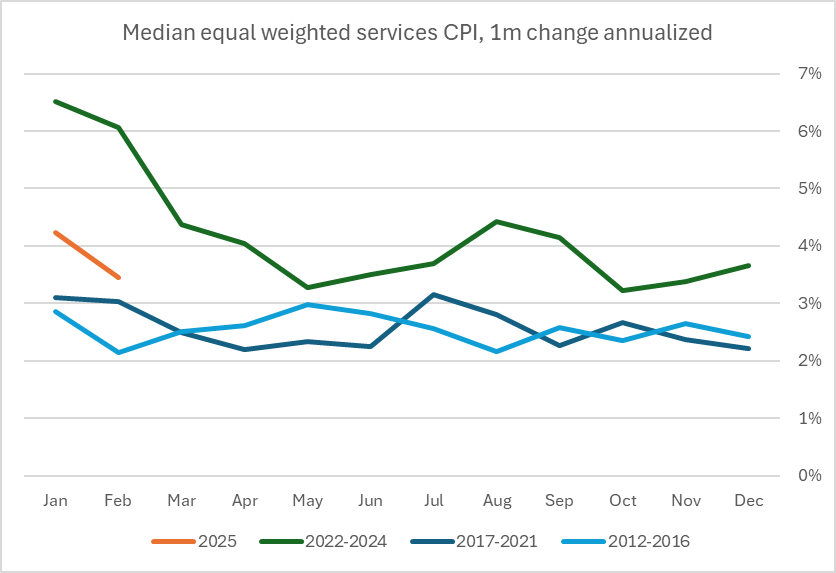

Services CPI, that was supposed to remain sticky, is moving towards pre-Covid ranges. Despite that, PCE inflation composition is expected to accelerate and force FED to be more hawkish in March, while economy and inflation are both slowing.

Overall, economic weakness is spreading into consumers and there’s potentially more to come.

Leave a comment